BLOG

Dec 13 . Mon

In order to boost domestic manufacturing and cut down on import bills, the central government in March this year introduced a scheme that aims to give companies incentives on incremental sales from products manufactured in domestic units. Apart from inviting foreign companies to set shop in India, the scheme also aims to encourage local companies to set up or expand existing manufacturing units

_(1)_6050e27e162d6.jpg)

BLOG

Dec 13 . Mon

March end is approaching fast, and the race to save tax. Given below is the ‘thumb-rule guide to help you to tax saving and interest on late payment of taxes at the filing of your income tax returns. We have placed the pointers in chronological order so that it takes us through a seamless flow:

BLOG

Dec 13 . Mon

Long-term capital gains (LTCG) are taxable under the Income Tax Act. However, you can get exemption on LTCG tax under Sections 54, 54F, and 54EC. While Sections 54 and 54F pertain to purchasing a house with the capital gains made, Section 54EC allows you to claim exemption from LTCG tax on the purchase of notified government bonds.

Capital Gain Bonds are being issued as “Long Term Specified assets” within the meaning of Sub Section 54EC of Income Tax Act 1961. Those desirous of availing exemption from the capital gain tax under section 54EC may invest in these bonds.

Capital gain arising from the transfer of the Long-Term capital assets can be invested in these bonds within a period of six months from the date of transfer of the asset for getting exemption from the capital gain tax under section 54EC. The maximum limit for investing in these bonds is Rs.50 Lacs and minimum Rupees Ten Thousand.

BLOG

Dec 13 . Mon

Are you one of those people who wants to earn regular income on their fixed-income investment? Then this blog is for you. And, when it comes to fixed income plans so there are so many options to invest in. PPF, NSC, bank fixed deposits, and the best one is NCD.

_606b328f77007.jpg)

BLOG

Dec 13 . Mon

An investment pool of debt funds is like a mutual fund or a foreign exchange fund where fixed revenue assets are a primary holding. A debt fund investment may invest in short-term or long-term bonds, securitized products, financial market tools, or the floating debt rate. The debt fund fee levels on average are less than the equity funds because the total administration expense is lower.

_606ddc3b9ba5e.jpg)

BLOG

Dec 13 . Mon

Normally when we asked for an investment in mutual funds for the long term, we heard from everyone who does SIP. As a layman, the first question that comes to mind is What is SIP?

_6072fe75b5885.jpg)

BLOG

Dec 13 . Mon

Companies have a variety of different ways of raising money. For example, IPO (Initial public offerings) is how businesses receive capital from retail investors. On exchanges such as BSE and NSE, the stock is listed after the IPO. The funds raised by the company during the IPO are then used for the growth of the business.

Likewise, they collect capital through NFOs (New Fund Offers) with AMCs (asset management companies). It is through an NFO scheme that new mutual funds come into being. Funds received in the NFO by the AMC are used for securities purchases in compliance with the scheme's mandate. NFO certainly seeks your attention if you are looking to learn more about mutual funds.

BLOG

Dec 13 . Mon

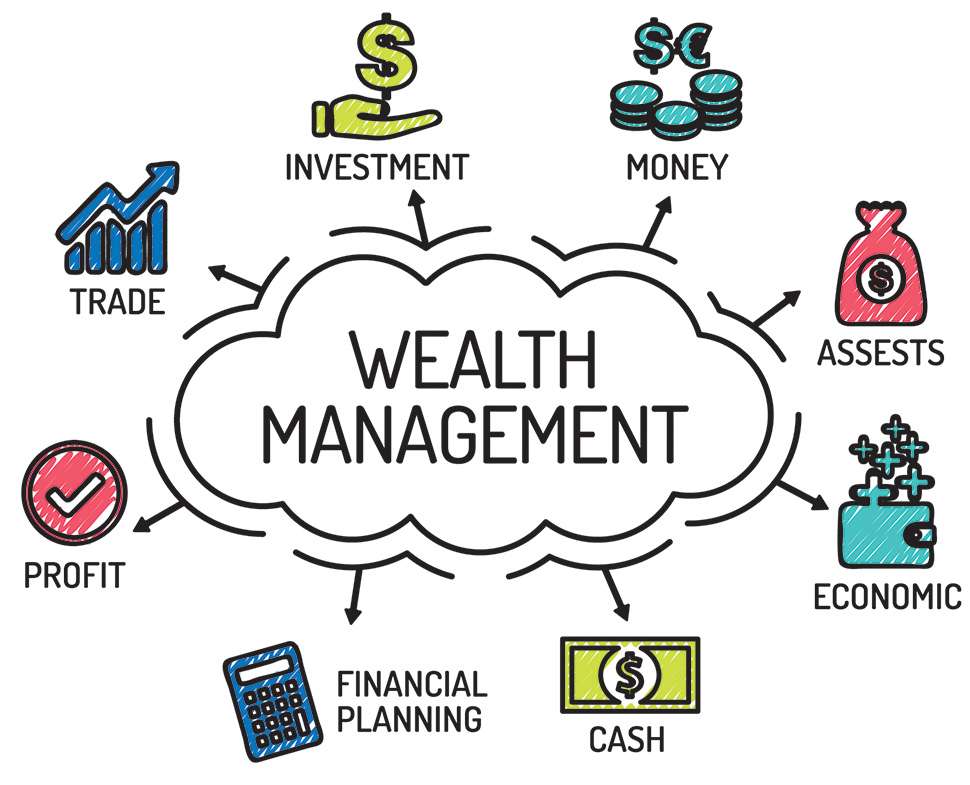

Hello readers, In today's blog we are going to discuss What is wealth management and how with the best wealth management strategy you can achieve your financial goal? There are several parallels between financial and physical health. Both are ongoing journeys, not one-time events. For example, it is not sufficient to achieve one's target weight but rather to sustain it at the same amount. Similarly, when it comes to our financial capital, it is more than just making money. Rather, one should concentrate on constantly expanding it.

Both of these journeys become simpler and more fruitful when you have a Wealth Management strategy that will guide you every step of the way. A personal trainer is to your physical health what a wealth management professional is to your financial health.

BLOG

Dec 13 . Mon

MFT (Margin Trading) Facility is a service that allows an investor to purchase shares and securities from available capital by paying a fraction of the overall transaction value (margin). Depending on the investor's availability, the margin may be offered in the form of cash or shares as collateral. In today's flog we are going to take a look at the most frequently asked questions about MTF trading. So, let's begin.

BLOG

Dec 13 . Mon

Mutual Funds for beginners, investing in mutual funds , Types of mutual funds, Beginner’s Guide to Mutual Funds, Mutual Funds Investment in India

BLOG

Dec 13 . Mon

Hello readers, a few weeks back we started with the series to make technical analysis easy for beginners. In our first part of the series e discussed What is technical analysis? Technical analysis is one way to analyze potential investments to determine if or when to buy or sell. And, today we are going to read about What is Japanese candlestick charting technique? how these candlestick patterns enable traders to understand the market? and how to understand these Japanese candlestick charting techniques? everything is covered in today's blog. So, let's begin with what is Japanese candlestick charting technique? And, the importance of candlestick patterns in technical analysis.

BLOG

Feb 28 . Wed

Long-term investment A strategy that is used by great investors like Benjamin Graham and Warren Buffett. But, What does long-term investment actually means? How one should define the best share for long-term investment in 2021? We recognize that the stock market can be volatile at times, but if you keep your money in the right stock for a long period, you will begin to see positive growth. All you have to do now is choose the best stock to invest in for the long term and watch the magic unfold. And today we will discuss the 5 Best stocks to invest in India for long-term investment in 2021.

BLOG

Dec 13 . Mon

Equity mutual funds, What is equity mutual fund? Equity mutual funds invest primarily in shares of listed companies. Equity funds may invest in companies belonging to different sectors and maybe diversified across different market capitalization segments like large-cap, mid-cap, and small-cap. Large-cap, mid-cap, and small-cap funds can be found in AMC based on their investing in distinct market capitalization sectors.

_60c60284574c0.jpg)

BLOG

Dec 13 . Mon

What does ETF stand for? An ETF stands for Exchange Traded Fund, which unlike regular Mutual Funds trades like a common stock on a stock exchange. The units of an ETF are usually bought and sold through a registered broker of recognized stock exchanges. The units of an ETF are listed in stock exchanges and the NAV varies as per market movements.

BLOG

Dec 10 . Fri

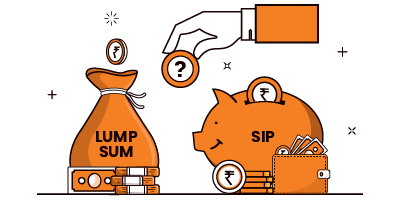

In our life, we always want different options. If we want to go for outstation then different options may be local or global and so on. Same way when we go for investing it also comes with different options as well choices. As an investor, you have different asset allocations like Debt, Equity, Mutual fund, currency, commodity, etc.

We are discussing investment in the mutual fund segment and how can you invest. The options of investment if different assets like debt mutual fund, equity mutual fund, or others are available options to investors which category or scheme investor want to invest. Along with the option, one can also choose how to invest in mutual funds. So, let's discuss what is systematic investment plan and lumpsum investment are and the key differences in both.

BLOG

Feb 28 . Wed

Tata Motors is coming up with another tranche of perpetual bonds after the first good tranche

BLOG

Aug 10 . Tue

Hello readers, I hope you have read our last blog on margin trading facilities. But, today we are going to talk about various types of margin in the stock market. The customer must deposit a certain amount of money with the broker in order to buy or sell stocks on the exchange. The margin is the name given to this amount of money. The degree of margin required by traders is determined by the exchange, as is the case with many other regulations, depending on the amount of volatility and volume. so let's take a deep dive into the types of margin in the stock market.

Just as we are faced with day-to-day uncertainties about the weather, health, traffic, etc, and take steps to minimize the uncertainties, so also in the stock markets, there is uncertainty in the movement of share prices. This uncertainty leading to risk is sought to be addressed by margining systems by stock markets.

BLOG

Dec 10 . Fri

With reference to the SEBI circular dated 20th July 2020, Peak Margin has been introduced in the Equity, Commodity & Currency segment from 1st December 2020.

W.e.f 1st June 2021, there will be an increase in PEAK margin from the existing 50% to 75% of the total margin. Accordingly, intraday leverage provided for Equity Cash and F&O Intraday will be changed.

This is an important update regarding Peak Margin which is going to be increased w.e.f. 01.06.2021 across the segments. The 3rd phase of peak margin (75% of (Peak margin obligation of the client across the snapshots) shall be compared with the respective client peak margin available with the TM/CM during the day. But before all that let's know What is Peak margin?

BLOG

Dec 10 . Fri

As you work towards your financial health and fitness, you must invest, no pun intended, in exercises aimed at wealth creation. Out of these exercises, stock market investments are one of the most efficient ones to improve your bank account balance. Hence we have prepared this beginner’s guide to Indian stock market. Everybody knows that investment in the Indian stock market is one of the most popular ways to strike wealth through the construction of a large body over the years. But the myth – which is too complicated – is what prevents people from investing in stocks. Investors beginning with the equity market are afraid because they assume it is risky, timely, and complex. Yet, this guide to Indian stock market will simplify everything for you.

This, however, is easier said than done. This guide teaches you how to invest in the Indian stock market. We provide a step-by-step beginner’s guide to the Indian stock market to make the process easier.

BLOG

Feb 28 . Tue

Want to earn good ROI on your short-term investment? Here's how having these 5 stocks might help you get it.

.png)